Author: Mark Ainely | Partner GC Realty & Development & Co-Host Straight Up Chicago Investor Podcast

When most investors think about vacancy, they focus on one number: how many days did it take to find a tenant? But after 23 years managing over 1,400 units across the Chicago metro area, I can tell you that's only half the story.

True vacancy isn't just the time it takes to find a qualified applicant.; It also includes those critical days between when the tenant signs the lease and when they actually move in. During that gap, you still pay the utilities, the property sits empty, and no rental income hits your bank account.

We love listening to the stories our data tell us here at GC Realty & Development, LLC. After analyzing 372 leases from our 2025 portfolio, we can give you the real picture of what vacancy looks like in Chicago. More importantly, we can tell you what you can do about it.

Many of our Straight Up Chicago Investor podcast listeners requested deeper data than what we cover in our episodes. So we’ve got super granular below to show why we take our data-driven processes so seriously.

The Numbers That Matter

Let's start with the headline figures from our 2025 leasing data:

Average days from on-market to move-in: 30.8 days

Average days from signed lease to move-in: 10.8 days

That second number is what I call the "hidden vacancy." Even after you've found your tenant, run background checks, collected the deposit, and signed the lease, you’re not making money yet. Owners still have an average of nearly 11 days before rent starts flowing.

That may not sound like much, but on a $2,000/month rental, that's roughly $733 in lost revenue per turnover. And did you know that money doesn't show up in your typical "days on market" calculations?

Monthly Breakdown: When Timing Works For (and Against) You

Vacancies due to days on market and gaps between signing and move-in days can accumulate more frequently during certain times of the year.

On-Market to Move-In Performance

The data shows significant seasonal variation in total vacancy time:

|

As you can see from the table above, June delivered our fastest turnovers at 24.4 days. Meanwhile, December lagged at 42.5 days, resulting in a gap of over 2.5 weeks. This 18-day spread between best and worst months represents real money. If you manage your own properties, timing your lease expirations to hit the June-August window can save you hundreds per unit annually.

The summer months (June through August) consistently outperform the rest of the year, with average turnover between 24 and 27 days. This aligns with our observations over decades in Chicago: families move before school starts, young professionals job-hop after spring graduation, and longer daylight hours make it easier to show properties.

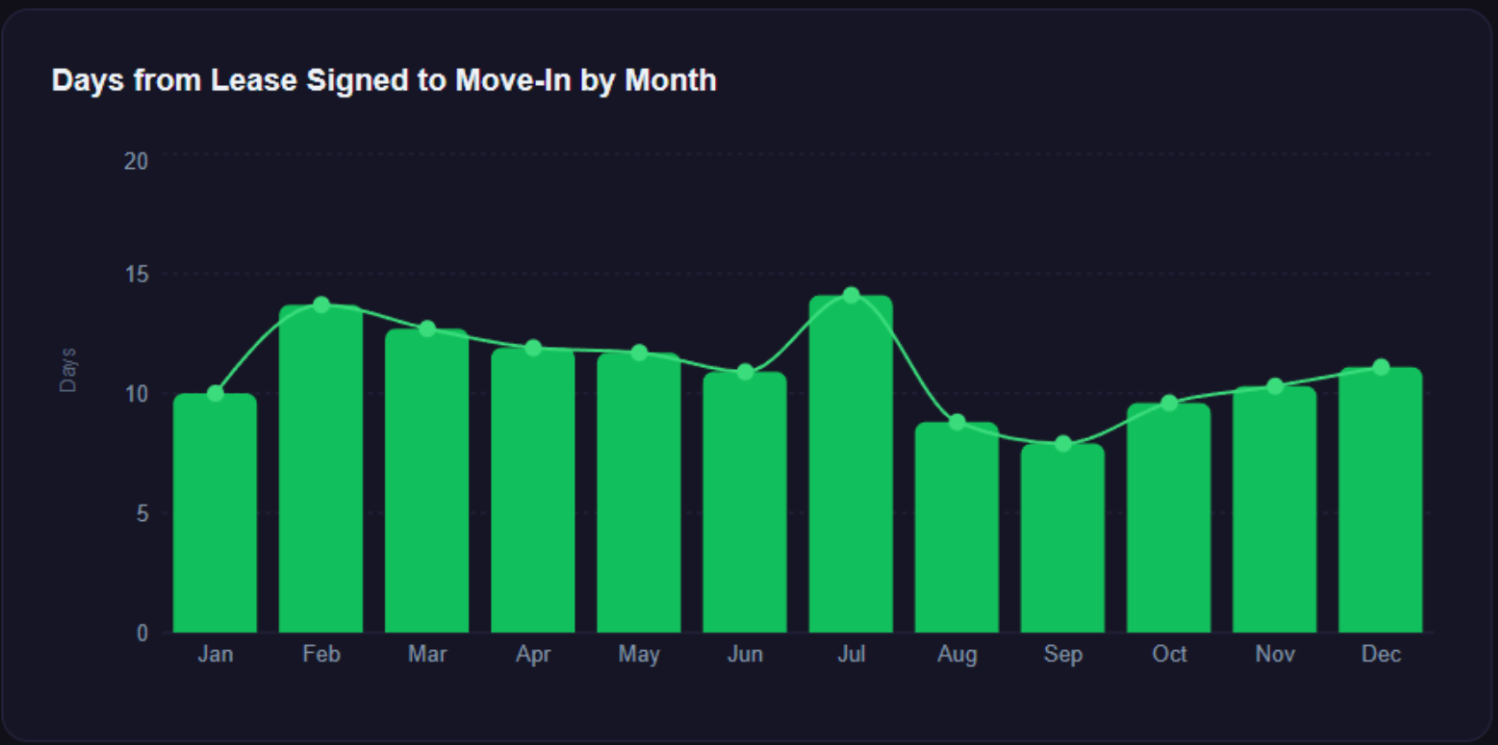

The Post-Signing Gap

Here's where the story gets interesting. The time between lease signing and move-in tells a different story:

September had the shortest post-signing gap at just 7.9 days. Meanwhile, July had the longest at 14.1 days. This seems counterintuitive. July is peak leasing season, so why the delay? The answer lies in lease timing and tenant circumstances. July signings often involve tenants who've secured a place early for August 1st or mid-August move-ins to align with school calendars. These tenants signed leases in July, but don't need immediate possession.

Meanwhile, September's tight 7.9-day7.9-day window reflects tenant urgency. By late summer, tenants who haven't found housing feel pressure and are ready to move fast once approved.

What This Means for Investors

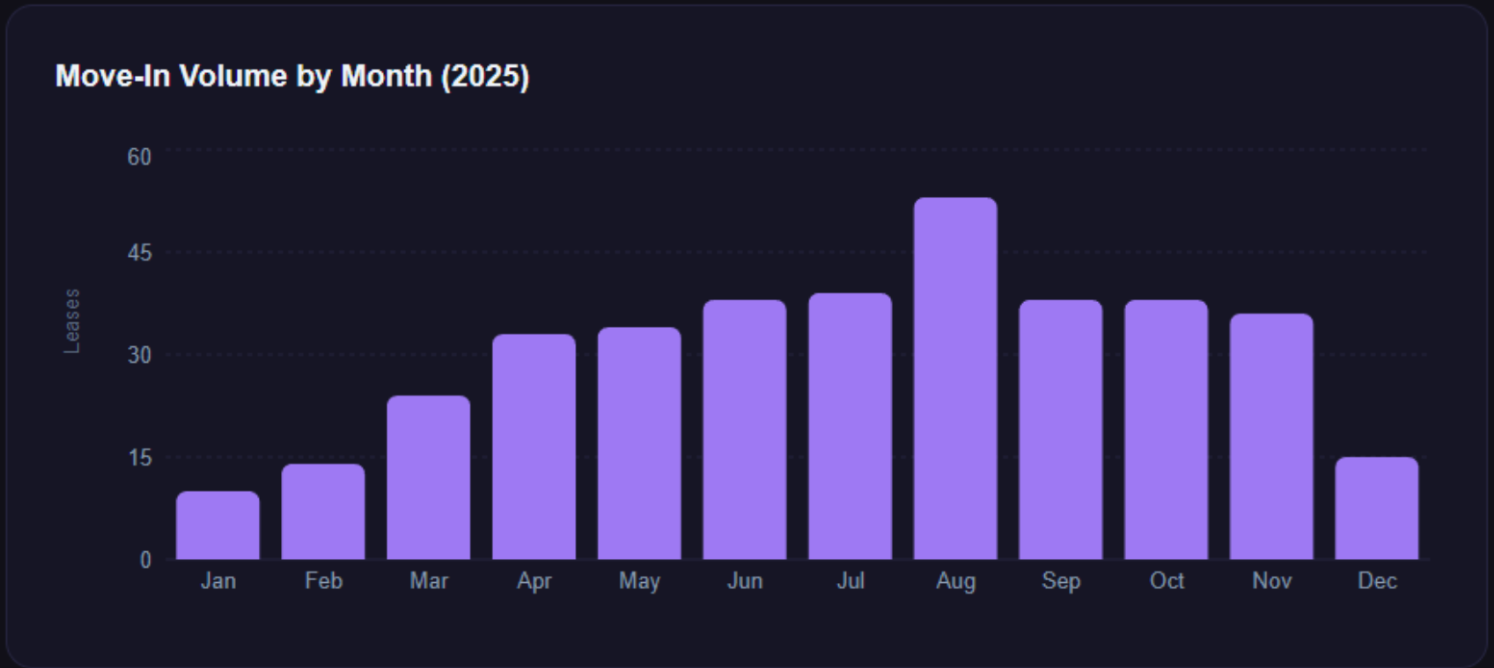

Below we offer a peek into GC Realty & Development’s numbers for 2025. Our move-in volume data reinforces the seasonal narrative:

Slowest month: January with just 10 move-ins

Peak month: August with 53 move-ins

Low season (January - February): 24 combined move-ins

Peak season (June - August): 130 combined move-ins

August alone accounted for 14% of our annual move-ins. If you haven’t positioned your properties to capture that summer demand, you're leaving money on the table.

Landlords: Benchmark Your Performance

If your turnovers take longer than 31 days from vacancy to move-in, you're underperforming in the Chicagoland market. Here's how our data breaks down:

Top quartile: Under 20 days

Median: 24 days

Average: 30.8 days

Concerning: Over 45 days

For the gap between signed lease and move-in, anything over 14 days warrants a process review. Do you require excessive lead time? Is your turnover crew taking too long to get units rent-ready? These operational inefficiencies compound across your portfolio.

Property Managers: Use These Benchmarks

If you professionally manage properties, these numbers should inform your client conversations and internal KPIs:

Target: Under 25 days from vacancy to move-in

Post-signing gap target: Under 10 days

Red flag: Any unit exceeding 45 days total vacancy

Track these metrics monthly. The seasonal patterns we've identified should help you anticipate slower periods and adjust marketing spend accordingly.

Strategies to Tighten the Gap

Based on our 2025 data and decades of operational experience, here's how to minimize true vacancy:

Pre-leasing Aggressively

Start marketing 45-60 days before the current tenant's move-out date. Our best-performing turnovers had signed leases before the previous tenant even vacated. This is especially true on the north and northwest side of Chicago. In these areas, our data showthat renters look much earlier in the process and don’t mind viewing occupied units.

Compress Your Turnover Timeline

Target 5-7 days for standard turns. Have your maintenance crew and vendors queued up before move-out day.

Negotiate Earlier Move-in Dates

If a unit is ready on the 15th, don't default to a first-of-the-month move-in. Instead, offer a prorated move-in. That extra two weeks of rent adds up.

Know Your Seasonal Windows

Structure your leases to expire during peak leasing season (May-August in Chicago). If you inherit a December lease expiration, consider offering a short-term renewal to shift it into a better window.

The Bottom Line

The average true vacancy in GC Realty & Development Chicago rental properties was 30.8 days in 2025. On average, nearly 11 of those days came after the signed lease agreement. You can control for that post-signing gap by implementing better processes, faster turnover, and proactive lease negotiation.

For investors: Track both numbers. If you use a property manager, they should report days-to-lease AND days-to-move-in separately to you.

For property managers: These benchmarks give you concrete targets. If you hit June-level performance (24 days total, 11 days post-signing) year-round, congratulations! You're running a tight operation.

This kind of granular analysis and performance separates professional operations from amateur hour. The difference between a 25-day turnover and a 43-day turnover, roughly the spread between our best and worst months, is $1,200 in lost rent on an average Chicago rental.

Multiply that across a portfolio, and you understand why these numbers matter.

Don’t Want To Go It Alone?

We’ve shared a lot of information here on investing in real estate locally in Chicagoland. If you live outside the area, those wanting to invest in the Chicago market could get overwhelmed. But at GC Realty & Development, LLC, we really see property management as a team sport.

Who’s on your investing team? Do you even have a team? GC Realty & Development, LLC has a dedicated team of professionals with decades of experience across all facets of real estate investment. We handle everything from brokerage to leasing and property management. Whether you hire us or not, we’re happy to provide our resources and expertise.

What gets me up in the morning and keeps me going 12 hours a day is the ability to add value to investors in Chicago and beyond! Those who connect with me often hear me say that our goal is to bring value to everyone we come in contact with.

We hope that, in return, they will one day hire us for our tenant placement or property management services, refer us to someone they know, or leave a review about our services. We'd love all three; however, we’re happy whenever we get the opportunity to help!

How can we make your life easier as an investor?

Reach out today!

Partner / Co-Host of Straight Up Chicago Investor Podcast

Vendor Portal

Vendor Portal