Author: Mark Ainely | Partner GC Realty & Development & Co-Host Straight Up Chicago Investor Podcast

In a recent podcast, we sat down with Luke Blahnik, a real estate expert, to dive into a major ordinance that will affect property owners in Chicago. The Northwest Side Housing Preservation Ordinance, which went into effect on October 9, seeks to preserve and expand the availability of affordable housing.

This newly expanded anti-gentrification ordinance has significant implications for rental property owners, particularly those in areas surrounding the 606 Trail. We’ve gathered the information property owners, agents, brokers, and investors alike need to navigate the new rules and stay compliant.

What Does the Ordinance Do?

The ordinance aims to preserve affordable housing and prevent gentrification by imposing restrictions on property sales and demolitions. Originally focused on a smaller area around the 606 Trail, the new ordinance has expanded both geographically and in its scope.

It covers a larger part of the city and introduces new provisions, including hefty fees for demolishing properties and new rights for tenants to purchase properties being sold.

Geographic Boundaries

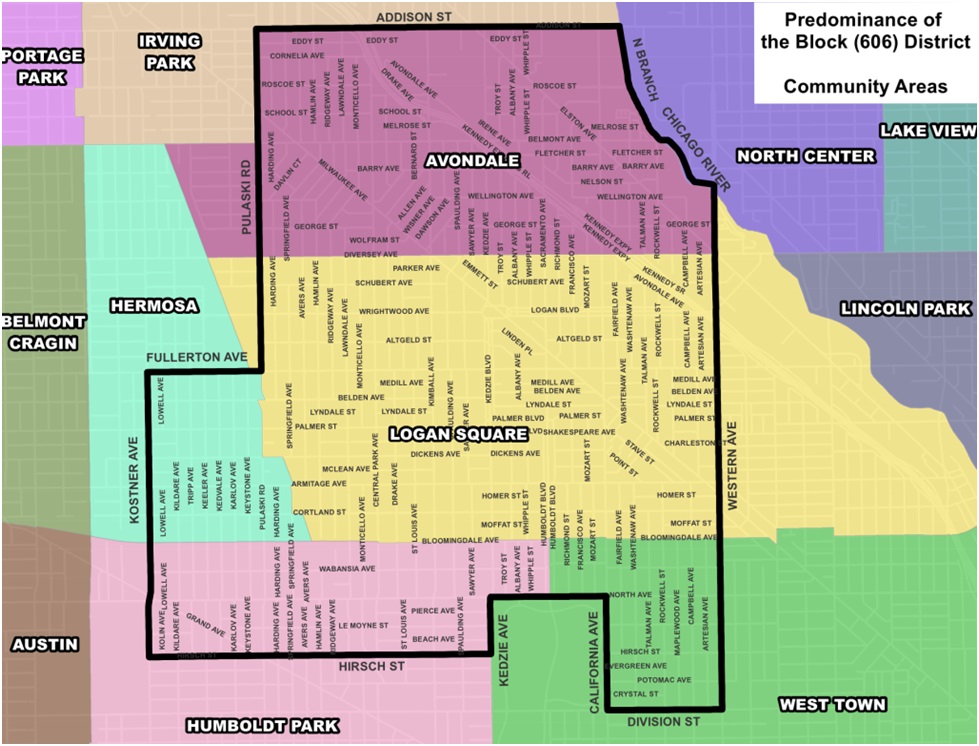

The new ordinance significantly widened the affected area, impacting more property owners, real estate investors, landlords, and developers.

The expanded area now stretches from Division Street to Addison Street (1200 to 3600 North) and from Western Avenue to Pulaski (East to West). This section covers 6 square miles, including Humboldt Park, Logan Square, and Avondale, in addition to a portion of Hermosa.

Key Provisions of the Ordinance

The new ordinance contains several restrictions that grossly redefine how existing properties can be bought, sold, demolished, or constructed.

Demolition Fees

One of the ordinance's most impactful aspects is the increase in demolition fees. These fees are in addition to the actual costs of tearing down the building. The surcharge goes toward a fund to preserve affordable housing within the ordinance's boundaries. At the time of this post, there was no additional information about this fund and how it will implement its goal.

Property owners looking to demolish buildings within the affected area now face a minimum fee of $60,000, or $20,000 per unit, whichever is greater. That means knocking down a four-flat property will cost $80,000. Larger, multi-unit properties face fees of $100,000 or more. Previously, the surcharge was a flat $15,000 within the smaller pilot area.

Predominance of the Block Rule

In an effort to keep the same number of residences available, the new ordinance places restrictions on the types of permissible construction projects. This provision aims to preserve the current housing stock and discourage the replacement of multi-unit buildings with single-family homes.

For example, it restricts the construction of detached single-family homes on blocks where less than 50% of the homes are already single-family units. Within the ordinance's boundaries, the vast majority of blocks (90%+) are two-, three-, or four-flat buildings.

That said, any new construction project still has to comply with R3 (Residential single-unit district) zoning density and height restrictions. So, a project to build a two-flat home has to be under 30 feet tall and have a 0.9 floor area ratio (FAR). In essence, the single-family zoning remains the same, but builders have to build a multi-unit building in a small box.

The ordinance does not provide widespread zoning relief or expansion into R4 or R5 zoning that allows for larger multi-unit structures. Rather, builders have to build a two-flat property but make it look like a single-family residence.

Tenant Opportunity to Purchase

Perhaps the most significant new addition to the ordinance is the "Tenant Opportunity to Purchase" provision. Property owners looking to sell their rental buildings must now offer tenants the opportunity to purchase the property before selling to an outside buyer.

This process involves several key aspects:

- Property owners of buildings of five flats or more must give tenants 60 days' notice of their intent to sell. Owners of smaller buildings must give 30 days’ notice. Regardless, the owner must deliver these notices to tenants in person or via certified mail.

- Then, after the owner lists the property and accepts an offer, they must notify the tenants. As part of the ordinance, owners must give tenants notice of the accepted offer from an outside buyer with a right of first refusal.

- From there, tenants have a period to decide whether to exercise their first right of refusal. For a five-flat building or larger, tenants have 90 days to decide. Tenants in three- and four-flat buildings have 30 days. Tenants in one- to two-flat buildings have 15 days.

- If the tenants choose to exercise their rights, the owner must now accept them as the official buyers rather than the outside offer. The owners can request up to 5% earnest money if that language is in an acceptance letter from the outside buyer. The tenant association has to match the earnest money.

- From there, the tenants have a specific period in which to close on the property. For five-flat properties or more, tenants have 120 days. Tenants in one-, two-, three-, and four-flat buildings have 60 days to close on the property.

The entire process can take up to 270 days (9 months), during which time the property cannot be sold to anyone else. However, if the property falls out of contract, the timer restarts (apart from the intent to sell notice time), meaning an actual sale could take years. For reference, a typical selling transaction between one buyer and one seller generally takes 30-45 days in total.

Owners must keep records of all these steps for three years to provide proof of compliance with the ordinance. Records include the name, address, and phone number of all current property owners; the property address; the unit count (i.e., number of flats) and number of bedrooms and bathrooms in each unit; asking price; a statement of intent to sell; and a summary of tenant rights.

Tenant Opportunity to Purchase Exemptions

While the ordinance intends to preserve affordable housing, a number of holes exist. For example, it’s unclear how owner-occupied multi-unit buildings are handled and whether condos are included in the ordinance. However, anything that isn’t really selling a property is an exemption to the ordinance, including:

Vacant Rental Properties

An interesting initial reaction to this new ordinance comes from property owners asking why they would sell a property still occupied by tenants. If there are no tenants, then they cannot form an association for the first right of refusal.

Transfers to Family Members or a Trust

Owners can transfer the property to another family member or place it in a trust with a real estate attorney.

Bank Foreclosure

Banks can foreclose on a property as part of the regular course of business for non-paying owners.

Property Owner Concerns With The New Ordinance

This new ordinance has raised concerns among property owners and investors, as it adds significant hurdles to selling properties.

Disclosure Issues

For example, the ordinance creates disclosure issues because property owners must provide financial information to their tenants. This means the tenants know how much everyone else in the building pays in rent. Tenants can request rent roll, vacancy reports, and a 12-month income and expense report for the building. This means property owners must disclose financial information to each other from everyone in the building. The contract becomes public in addition to each tenant’s information.

Lengthy Timeline and Red Tape

Once a property owner gives notice to tenants of an accepted offer, owners and (hopefully), the buyer have to wait to see if the tenants will exercise their right to buy. However, owners cannot ask tenants for financial information (like a pre-approval letter from a bank) demonstrating their ability to purchase the building at any point.

The lengthy timeline and added red tape may deter potential buyers, making it harder for owners to sell their buildings, especially if they find themselves in a financial bind. Plus, as we mentioned earlier, if a buyer falls through, the timeline starts all over again.

Tenant Ulterior Motives

The unfortunate side effect is that this ordinance drives a stake through what could be otherwise harmonious relationships between an owner and their tenants. Many owners fear that the ordinance could be used as leverage by tenants who express interest in purchasing properties without the actual means to do so. A well-organized group of tenants can potentially drag out the sale process or cancel it altogether.

Doesn’t Solve Deadbeat Landlord

The new ordinance will not solve issues with deadbeat landlords. The city already has multiple ways for tenants to report landlords violating Landlord-Tenant Ordinances. Instead, small mom-and-pop landlords will struggle to stay in compliance with the new ordinance and quickly find themselves getting sued.

Impacts on Chicago’s Real Estate Market

The ordinance has been criticized for its potential to further discourage investment in Chicago's real estate market. Property owners and investors already face challenges due to fluctuating market conditions, and these new restrictions add another layer of complexity. Plus, with the expansion from the previous ordinance, investors worry the ordinance will expand further and include additional areas within the city.

As Luke mentioned in the podcast, many landlords are now considering selling their buildings without tenants. The ordinance creates a disincentive to keeping rental units occupied if they plan to sell, which eats into the return on investment in the property, which is why people become real estate investors.

Lack of Clarity and Rapid Implementation

Another major issue highlighted in the discussion is the rapid implementation of the ordinance. It was introduced at a zoning meeting on a Tuesday and passed through City Hall by that Thursday with little public input or involvement from the housing industry.

This lack of transparency and clarity has left many property owners scrambling to understand their new obligations and rights under the law. Even worse, some owners, investors, and even tenants may need to be made aware of the new ordinance and its implications for them.

Next Steps

The expanded anti-gentrification ordinance is a game-changer for Chicago property owners and investors, particularly those with rental properties in the affected areas.

Owners, investors, agents, brokers, and tenants must understand the new rules and comply with them. Anyone impacted by the new ordinance should contact their local elder person and understand why they voted for it. Finally, because of the drastic changes and impingement on property business, those within this boundary can expect the ordinance to be challenged in court.

If you plan to sell or redevelop property in these neighborhoods, stay informed about the new requirements and prepare for the possibility of longer, more complicated sale processes. If you need help finding a good investment deal, we can help!

Ready to get expert advice on how to handle these new regulations? Schedule a consultation with GC Realty & Development today!

Reduce Your Risk Today |  Refer & Earn Today! Refer & Earn Today! |

Vendor Portal

Vendor Portal