Author: Mark Ainely | Partner GC Realty & Development & Co-Host Straight Up Chicago Investor Podcast

As someone who has been actively investing and managing rental properties across Chicago and our surrounding suburbs for well over a two decades, Here is what I believe is a pivotal piece of legislation: Illinois House Bill 3564 (“HB 3564”), scheduled to take effect July 1, 2026. While the bill is framed as enhancing tenant protections, from my vantage managing 1400+ units across the region, it carries implications and some unintended consequences for tenants that every investor in the Chicago market needs to understand.

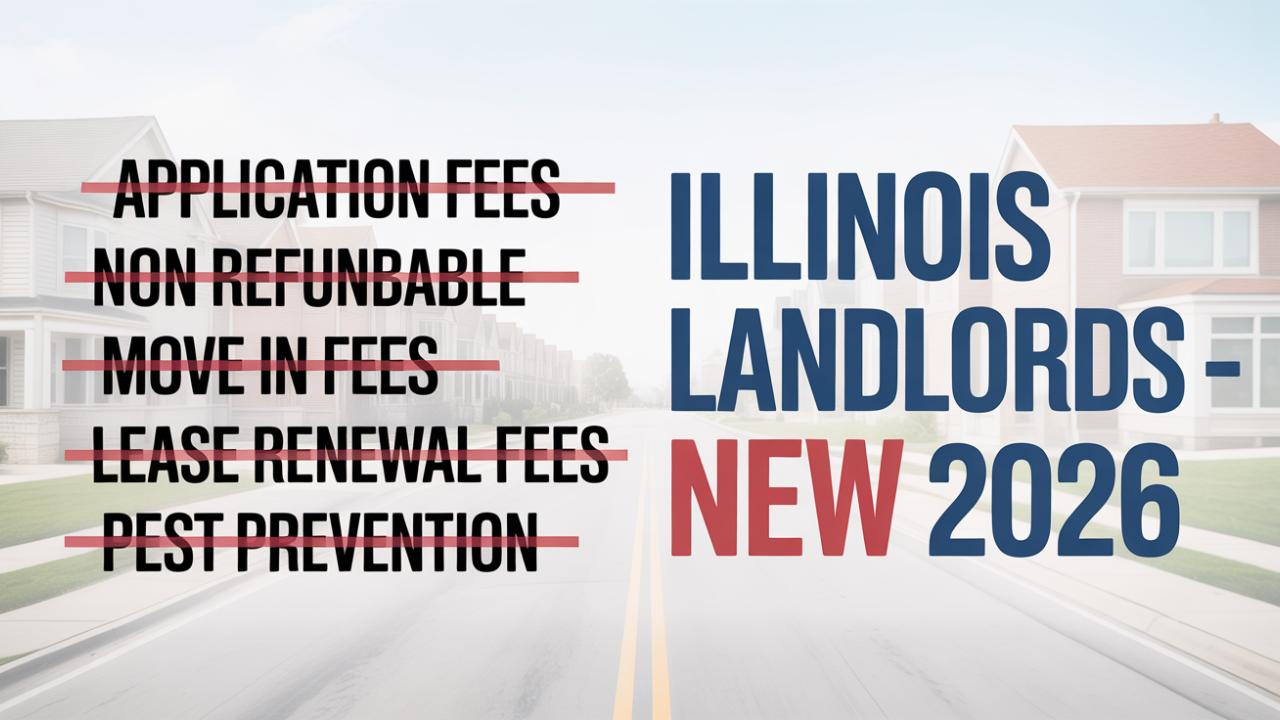

What Is New In HB 3564

Below are the major provisions of the legislation as amended in this past week(October 2025) and will take effect July 1, 2026.

Fee transparency: All non-optional fees, whether one-time or recurring, must be explicitly listed on the first page of the lease agreement. If a fee is not so disclosed, the tenant is not liable for that fee.

Listing disclosure requirement: In the property listing and/or lease‐disclosure, the landlord must disclose in a “clear and conspicuous manner” all non-optional fees and must disclose whether utilities are included in the rent.

Application fee cap / background check fee rules (“junk-fee ban”):

The landlord cannot charge a rental application fee (including background checks) in excess of $50, unless the actual cost of a third-party background check is higher. If so, the landlord may charge the excess only if:

If the landlord fails to submit the bill + receipts within 14 days, the fee is waived.

Under no circumstance may this fee be used as a basis for eviction within the first year of that lease.

Prohibited fees/fines: The bill explicitly prohibits landlords or lease agreements from requiring the tenant to pay certain kinds of fees or fines, including, but not limited to:

A fee or fine ancillary to the application fee at the time of application.

A fee or fine for modification or renewal of a lease.

A fee or fine for an eviction notice or the filing of an eviction action prior to the court granting an eviction order (although landlords can still recover court costs and filing fees).

A fee or fine for contacting the building owner or property manager for maintenance or service requests, lease questions, or other items directly related to the tenancy.

A fee or fine for travel required to complete needed maintenance work or safety repairs.

A fee or fine for a maintenance hotline service or call to that service for maintenance or service requests, lease‐related questions, or other tenancy‐related items.

A fee or fine for the routine maintenance and upkeep of the unit (so long as the tenant has not contributed to the condition).

A fee or fine for pest abatement or removal where the tenant has in no way contributed to the infestation.

A fee or fine for an in-person walk-through of the unit at the time of move-in or move-out.

Local government (home-rule) carve-out: Any home-rule unit, non-home rule municipality or non-home-rule county may regulate fees charged to tenants, but such regulations must at minimum restrict fees in a manner equal to or more protective than this Section.

Applicability / Exclusion for small owner-occupied buildings: This Section applies to all lease agreements for residential rental property entered into after the effective date of the Act (July 1, 2026). However, it does not apply to lease agreements for dwelling units in owner-occupied premises containing 6 units or fewer.

Penalty / Enforcement: A person alleging a violation may bring a civil action in any court of competent jurisdiction. The court may order injunctive relief, monetary relief, attorney’s fees and costs.

Unintended consequences for renters

On the surface many of these changes look like wins for tenants: capped application fees, stronger fee transparency, banned “junk” fees, clearer disclosure. However, I already see several unintended, and to some extent under-appreciated, ramifications. These may end up working against the very tenant populations the law intends to protect.

Narrower approval pools / greater screening

Because the legislation removes or caps certain revenue levers (application fees, renewal fees, certain “extras”), and restricts the ability to impose certain fines and fees, landlords and property managers are likely to shift their risk tolerance downward. In practical terms this means: I will demand stronger credit, more stable income sources, fewer “alternative income” cases, lower risk turnover, fewer “special‐program” tenants (e.g., voucher holders) unless I can be confident in them. Therefore, renters who don’t have pristine credit, lengthy steady employment, or traditional income might face tougher roadblocks. Even though the law aims to broaden access, in practice some renters may see fewer opportunities.

Higher base rent or substitution of other cost structures

If application fees and renewal fees go away (or cannot be charged) and landlords’ cost side remains fixed (taxes, insurance, maintenance, regulatory compliance, labor, materials), landlords may respond by raising base rent or reducing “extras” or concessions, or shifting to more strict lease terms. So while upfront costs may fall, ongoing cost for tenants could rise. In some cases, the “cost of renting” is transferred rather than eliminated.

Less flexibility in lease terms or incentives

Landlords often use application fees, renewal fees, move-in specials, flexible compensation models to fill units, especially in competitive suburban markets. With fewer “secondary fees” available and more cost/administrative risk, landlords may reduce concessions (e.g., “first month free”), require longer leases, tighten more restrictions. That may disadvantage new renters or renters switching units who relied on incentives.

Reduced maintenance or amenity investment

If revenue and margin pressure increases (due to tighter fee regulation) while operating costs continue to escalate (especially in Chicago/suburbs where insurance, property taxes, labor are up), some landlords may defer non-essential maintenance, reduce amenity upgrades or reduce optional services. For tenants, that means quality of housing might degrade over time, especially in the older‐stock suburban inventory that is already under pressure.

5. Supply constraints for moderate‐income renters

The more subtle consequence: for moderate‐income renters (those not lowest‐income but also not high income), the supply of appropriately sized, well-managed rental housing may shrink. Why? Because investors and small landlords may conclude that the margin is too tight (given higher cost, regulatory risk, fee restrictions) to invest in units targeting that cohort. The result: fewer moderate‐rent units entering or being maintained, and possibly increased competition and higher prices for the remaining supply. In short: even with fee protections, access might shrink.

So in summary: while the intent of HB 3564 is laudable, greater transparency, fewer hidden costs, expanded access, there is a risk that the practical ripple effects result in less access, higher effective cost, and stricter tenancy criteria for many renters.

Why these changes will lead to reduced new housing development

From the perspective of someone underwriting deals and managing the economics of rental investments across Chicagoland (including suburbs), the mechanics of new development or acquisition are impacted by this legislation in a material way.

Capital stacking and underwriting gets tougher

When I run a pro‐forma for acquiring or developing rental housing, I build in assumptions for vacancy, turnover costs, application/screening fees, late payment risk, maintenance reserves, cap-ex, and regulatory compliance. One of the levers I count on is the ability to charge certain fees that help offset screening/turnover cost or mitigate risk. HB 3564 restricts several of these fee levers, so my forecasted net operating income (NOI) goes down (unless I adjust other line items). Lower NOI means fewer deals clear my return hurdle, fewer acquisitions get green-lit, fewer developers break ground. That means fewer new units coming online.

Reduced return / longer hold periods

Because margin is squeezed, the expected IRR on deals drops unless higher risk is accepted or base rents are increased. Investors being rational will require higher returns to compensate—or withdraw capital altogether. That means a slower pace of new builds or acquisitions in the Chicago & Chicago suburb market. Supply growth slows when deal count declines.

Higher cost of capital / more conservative financing

Lenders and equity providers will view Illinois rental‐housing investment as having increased operational risk because of limited fee/fine levers and greater regulatory oversight. That perception could lead to higher interest rates, stricter underwriting, lower loan‐to‐value or more required equity. All of which raise the cost of capital and reduce feasible deal size. Development is less attractive in that environment.

Supply side contraction in “mid-market” rental stock

The type of housing most sensitive to these economics are smaller builds (10–50 units) or value‐add conversions in suburban markets aimed at “moderate” price point renters. If investors exit or refrain, fewer of these units get built or maintained. The ripple for renters: fewer choices in the middle of the market (not subsidized, not luxury). That pushes demand toward either higher‐end or historically deeply affordable stock, neither of which may serve the middle.

Risk of capital flight / alternative states

If Illinois is increasingly perceived as more “landlord‐unfriendly” or regulatory burden increases relative to peer states, capital may divert to more favorable jurisdictions. That means fewer dollars chasing new rental projects in Illinois, further lowering development. For a region like Chicagoland with strong demand but constrained supply, that is material.

Thus: the regulatory change does more than tweak operational practice—it reshapes the economic viability of rental housing investment in the region. When investment slows, supply growth slows; when supply growth slows while demand remains, pressure builds on both occupancy and pricing dynamics.

How landlords will become more strict in tenant-selection criteria due to increased risk exposure

I make the following statements using the term “I” and that is not specific to Mark Ainley or GC Realty & Development but from the vantage point of the individual investor and in this case is most of the time the “Mom and Pop investor who owns 95% of the housing stock in Chicago.

Let’s get concrete: as someone doing this day-to-day, one of my core risk-mitigation tools is screening, credit checks, income verification, application fees, security deposits, late fees, lease enforcement. When some of those levers are diminished or costlier, I’ll adapt by tightening other levers. So here’s how landlord behavior will likely shift in the Chicago/suburban market.

More stringent credit and income requirements

Because I’m losing some revenue levers (application fees in excess of $50 limited, various fee categories banned) and facing tighter penalty options, I compensate by shifting into a lower‐risk applicant pool. That means I’ll require higher credit scores, longer steady employment history, fewer job changes, lower debt‐to‐income, stronger rent‐to‐income ratios. In short: fewer “moderate risk” applicants.

Larger security deposits (within legal limits) or co-signers

While the legislation doesn’t explicitly cap security deposits (in this Section), landlords will likely lean heavily into deposit/guarantor strategies when allowable. If I cannot rely as much on fees/fines, I want more upfront protection. That raises the barrier for renters who don’t have large liquidity or co‐signers.

Shorter lease terms or more frequent renewal screenings

In an environment of increased risk, I may shorten lease terms (e.g., 6 months vs 12), or add stricter renewal criteria (e.g., fresh credit/income check at renewal). That gives me flexibility to exit higher‐risk tenants sooner. For the tenant this means less stability.

More conservative rent setting / fewer concessions

Historically, to fill units I might offer move‐in specials, waive application or renewal fees, accept alternative income sources (like housing vouchers) if mitigated properly. Post-HB 3564 I’ll be less inclined to offer concessions, because the margin shrank, and I’ll prefer straightforward, standard applicants. That reduces flexibility for renters and might increase competition among them.

More vigilant lease violation enforcement

When margin is squeezed and risk tolerance decreases, I become less forgiving of late payment, unauthorized occupancy, pets, sub‐leasing. The cost for me (landlord) of managing problem tenants rises relative to my return. I will exercise my enforcement rights more quickly. That means renters with less‐stable income or temporary situations may face a tougher environment.

Selective acceptance of alternative income/“source of income” households

Although HB 3564 doesn’t here directly amend “source of income” protections in this Section (that may have been in earlier versions), the risk environment changes. If I view tenants whose income comes from housing vouchers, gig work, or non-traditional sources as higher risk (because I can’t offset other fee/fine levers), I will raise the bar for them. The result: though the law might intend broader access, I may inadvertently tighten access for alternative income households.

In short: the center of gravity shifts from how much you pay upfront (application/move-in fees) to how safe you look (credit, income, employment stability). The net result: stricter selection, fewer borderline tenants accepted, more “A‐tenant” crowd.

Conclusion: Chicago still a strong investment opportunity — but risks like HB 3564 must be factored

To wrap up: yes, the Chicago area remains, in my opinion, one of the stronger real‐estate investment markets in the U.S. The fundamentals are supportive: large, diverse economy; continuing population growth (especially in outer suburbs); constrained supply of truly affordable rental housing; favorable cap-rates compared to some coastal markets; and institutional interest that continues to validate the asset class.

However, and this is a big however, legislation like HB 3564 underscores that regulatory risk matters, and prudent investors must factor it into their underwriting, acquisition decisions, and operational strategy.

From my perspective as Mark Ainley (with my GC Realty & Development hat on), here are the take-aways:

When underwriting a deal in Chicagoland, you must adjust the revenue model downward to reflect mandatory fee transparency, stricter fee limitations, increased screening/higher tenant quality standards, and possibly higher turnover or risk.

Factor in that tenant‐selection is likely to become more conservative across the board—meaning vacancy risk may drift slightly upward, and unit acceptability (for moderate, voucher, or alternative‐income tenants) may shrink unless the deal is structured accordingly.

Supply risk becomes real: fewer new units may come online (especially in the moderate‐rent category) because small/mid‐sized operators will see tighter margins. That might bolster rents long term—but it also increases competition for good assets.

Operational discipline becomes even more critical: keep expenses under control, maintain margins, ensure strong tenant screening and retention, and track legislative/regulatory trends proactively.

Despite the headwinds, Chicago remains strong—if you approach it with the right assumptions. The presence of universities, major corporations, health-care clusters, transit access, and suburban growth trajectories all point toward durable demand for rental housing.

In short: HB 3564 is not a show‐stopper, but it is a game-changer. It shifts how the business of rental housing must be managed in Illinois. It tightens operational levers, raises the bar for tenant quality, and slightly tilts the supply side. For renters it may seem like a win on paper, but for investors and operators, the cost of doing business just went up a notch.

My recommendation: don’t ignore it. Re‐model your deals, revisit your screening criteria, build more conservative assumptions, and anticipate that your target tenant pool and underwriting assumptions may need adjustment. But also don’t retreat, Chicago remains a viable, even attractive, market, with the appropriate strategy and awareness of these evolving regulatory dynamics.

How GC Realty Is Getting Ready

We’ve already seen how quickly Illinois housing regulations evolve. GC Realty & Development is updating all lease templates, disclosure pages, and application processes to stay ahead of the 2026 transparency requirements.

Our philosophy has always been simple:

Transparency is good business.

When tenants know exactly what they’re paying for, disputes go down, renewals go up, and compliance becomes automatic.

If you manage your own units, now’s the time to review your systems. Or, if you’re ready to hand off the hassle, our Tenant Placement Service and Full Property Management options are built for exactly this, compliance made simple.

Q&A: Common Landlord Questions About HB 3564

Q1: When does the new junk fee ban take effect?

The amendment takes effect July 1, 2026. That means landlords have roughly a year and a half to update leases, listings, and screening processes.

Q2: What happens if I forget to list a fee on the first page of the lease?

If it’s not disclosed on the first page, the tenant doesn’t have to pay it, even if it’s in the lease elsewhere. Transparency must come first.

Q3: Can I still charge for background checks over $50?

Yes, but only if the third-party screening company’s actual cost is higher. You must pay for it upfront, then submit the invoice and receipts to the applicant within 14 days. Miss that deadline, and you lose the fee.

Q4: What about move-in or move-out inspections?

You can’t charge for in-person inspections or walkthroughs. They’re now considered a standard part of managing property.

Q5: How does this affect my rent pricing?

If certain fees are no longer allowed, you’ll likely need to factor those costs into your monthly rent. That’s why accurate market pricing is critical, GC Realty’s Free Rent Analysis helps you see how your property compares so you can stay competitive without underpricing.

Q6: Can tenants sue for violations?

Yes. The law allows tenants to take landlords to court for noncompliance and seek damages, injunctions, and attorney’s fees.

Q7: Does this replace the Chicago RLTO or Cook County RTLO?

No, it adds another layer. If you’re already under RLTO or RTLO, you must still follow those. This bill adds statewide rules for everyone else.

Q8: How do I know if my leases and fees are compliant?

You can review the full amendment or talk to a property management company that stays ahead of Illinois housing laws. GC Realty continually monitors legal updates and adjusts our leases and systems to keep owners protected.

The Takeaway

Laws like House Bill 3564 are changing how rental housing operates across Illinois. The government wants transparency; tenants want predictability; and landlords want to stay profitable without stepping into legal traps.

That balance isn’t easy, but it’s absolutely possible, especially when you have the right systems and team in place.

At GC Realty, we believe that compliance isn’t just a rule to follow; it’s a strategy to protect your investment. The landlords who take this law seriously now will be the ones who thrive later.

Next Steps for Landlords

✅ Check your leases. Make sure every fee is listed on page one.

✅ Audit your listings. Be transparent about utilities and non-optional costs.

✅ Cap your application fees. Get ahead of the $50 limit before 2026.

✅ Get expert help. Use GC Realty’s Free Rent Analysis to stay competitive and compliant.

Don’t Want To Go At This Alone?

We’ve shared a lot of information here on investing in real estate locally in Chicagoland. If you live outside the area, it may seem overwhelming for those wanting to invest in the Chicago market. But we really just look at it as a team sport.

Who’s on your investing team? Do you even have a team? GC Realty & Development, LLC has a dedicated team of professionals willing to share decades of experience in all facets of real estate investment. We handle everything from brokerage, leasing, and property management. Whether you hire us or not, we’re happy to provide our resources and expertise.

What gets me up in the morning and keeps me going 12 hours a day is the ability to add value to local area investors in Chicago and beyond! Those who connect with me often hear me say that our goal is to bring value to everyone we come in contact with.

We hope that in return, they will one day hire us for our tenant placement or property management services, refer us to someone they know, or leave a review about our services. We would clearly love all three; however, we’re happy whenever we get the opportunity to help!

Reach out today!

Partner / Co-Host of Straight Up Chicago Investor Podcast

Vendor Portal

Vendor Portal